Want to understand how bitcoin stock to flow model works? This post will show in detail how bitcoin stock to flow model works. Bitcoin’s Stock to Flow (S2F) model is among the leading quantitative models that aims to predict the cost of Bitcoin until 2026. Given that the rate of Bitcoin in the next 5 years refers much debate in the cryptocurrency and conventional monetary markets alike, it’s essential to evaluate well-established price designs periodically considering the rate the crypto-verse is progressing at.

It is actually the first model that attempts to quantify the relationship between the relative deficiency of the first-ever scarce digital currency, Bitcoin (BTC) and its cost. Even though S2F model is only an examination structure for Bitcoin, it is safe to say that because it gained popularity it has driven capital streams to the asset.

What is Stock to Flow Model?

The stock-to-flow model is actually applicable to Bitcoin due to the limited and restricted nature of supply. The model is usually appropriate to limited products like gold, platinum, etc, and not extensively offered commodities like the oil and copper. The only major difference being that the former only have actually restricted supply injections and are thought about to be restricted in quantity, while the latter has a high supply which is in theory thought about to be unlimited.

The deficiency is described as the metric of the stock to flow (SF) ratio. That is one major factor that makes gold and bitcoin different from “consumable products” like copper, nickel and brass, as they have a high SF value. The higher the SF ratio value entails that the possession also has low price elasticity of supply.

SF = Stock/ Flow

Stock is actually the existing supply of Bitcoin in circulation. Flow describes the number of tokens mined in a year. Instead of the SF ratio, the supply development rate is also utilized. SF = 1/ supply development rate.

As BTC has its max supply restricted to 21 million tokens and mining a brand-new token is a time and energy-intensive process, the supply influx of Bitcoin is restricted to a particular amount that can come into flow within an offered timeframe. This model takes this shortage and supply limitation into account while forecasting the price of BTC. The calculation for the rate the model forecasts is based upon a formula that uses variables like the month-to-month stock to flow worth and rate information.

PlanB’s model reveals that there is an indicator of a power law relationship. This is a relationship in between 2 variables of a direct regression function, which illustrates that the relative modification in 1 quantity triggers s proportional change in the other quantity. This relationship exists regardless of the initial size of those quantities. Essentially, it reveals the impact of the routine Bitcoin halving occasions where the SF doubles and the marketplace worth apparently increases 10x, and this is constant for each halving event.

History of the Bitcoin Stock to Flow

The Stock to Flow (S2F) model for the Bitcoin was promoted by the Twitter pseudonym, PlanB, more than 2 years ago in the middle of the minor bull run of Q1 2019 in March 2019. PlanB is popular Twitter user in the crypto community who is unnamed Dutch financier. He initially discussed this model in a Medium Modeling short article titled, Modeling Bitcoin Value with Scarcity.”

As the title suggests, it was an attempt to rate Bitcoin in proportion to its deficiency. It broadens the stock to flow prices model that is usually appropriate for scarce commodities like the Gold and Silver and expands it to the price Bitcoin in accordance with that supply influxes that token would witness in the upcoming 5 years. It has really grown to become one of the most accurate price forecast designs that the crypto market has actually ever seen.

However, it is essential to note that given that quantitative monetary designs are typically built on historic information, it could be handy to determine the general patterns and sentiment in the market in a provided timeframe, but pattern aberrations are difficult to determine in advance.

PlanB’s model has brought to life another indication that indicates whether the property is misestimated or undervalued at a given time, based on its SF ratio, the stock to flow deflection. It is the ratio in between the marketplace price of Bitcoin to its stock to flow ratio. If the deflection is really above 1, according to the model, the possession is miscalculated while if it is less than 1, the property is undervalued.

How to Utilize Bitcoin Stock to Flow Model

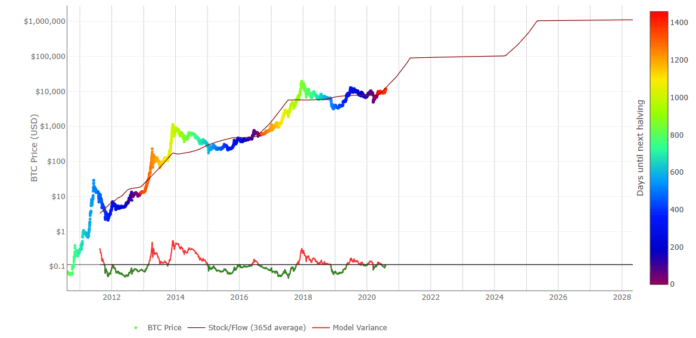

Bitcoin S2F model is a live chart information model that can be utilized easily to track the predicted price of the possession at a provided point of time and the real market value of the asset at that time. When the data points are indexed in accordance with the time, it’s called time series model.

The charts contains the forecasted price of Bitcoin on the y-axis and the timeline from 2010 to 2026 on the x-axis. Over this line chart, the marketplace rate of Bitcoin is outlined throughout the chart to develop a comparative view of the anticipated price vs the marketplace cost. Using this chart you can see just how much the existing price of Bitcoin differs from the forecasted cost at an offered time, historically also.

For believers of this model, the charts combined together can also be viewed as an indicator to buy or offer the possession. Negative discrepancies from the forecast cost line could be interpreted as signals to buy the dip while favorable discrepancies could be interpreted as signs to sell as the property is now misestimated. The stock-to-flow deflection ratio is the very best metric to assess this.

Has the Bitcoin S2F Model been revoked?

A closer analysis of the expediency of the S2F model in the existing market circumstance is now under concern. Historically, this model has been among the most accurate rate forecasting models for Bitcoin, as noticeable in the live data chart of the model and the stock-to-flow deflection.

Considering that the flash crash of most of the crypto market on May 19, a day now more commonly referred to as Black Wednesday, the cost forecasts of the model are frequently given question.

According to PlanB’s model, BTC’s rate is supposed to have actually passed by $100,000 by now; as of Aug 10, it is trading at $45,000, less than half of the anticipated price.

In June PlanB anticipated that Bitcoin’s cost might reach $450,000 by the end of this year. He likewise mentioned that it could strike a minimum of $135,000 in the worst-case situation. According to model, the price is predicted to go past the favorably coveted $1 million mark nearly 4 years from now, in July 2025.

But that prediction could seem like stretch, an indicator of this was a survey PlanB himself hung on Twitter. In June this year, he shared the outcomes of a survey which exposed that 41% of the poll takers have the belief that the price of Bitcoin will stay under $100,000 this year. This percentage is high compared to a comparable poll he took in March this year, which revealed that the same metric was at 16%. At this moment in time, the token was trading at $55,000.

However, it is essential that when the second study was taken back in June, Bitcoin was exchanging hands around the $34,000 mark. Since then, the market has actually seen another rebound in interest and Bitcoin is leading the charge, trading around $45,800 at the time of writing. The token has actually published 19.71% gains in the last 7 days. This has actually led the market capitalization to recover from $649 billion at the end of July to currently standing at $860 billion on Aug 10.

Considering this rebound and the volatility of cryptocurrency markets in general, it is not entirely possible to dismiss any price prediction and conclusively assess the accuracy of PlanB’s S2F model. It is likewise notable that despite the fact that ever since the model entered the public consciousness in March 2019 it has been relatively precise in predicting BTC’s rate, in the bull run beginning late in Q4 2019, the market cost of token went beyond the forecasted price till May this year. This might likewise be thought about as an aberration as the associated stock to flow deflection value would suggest that the token is overvalued.

This is not the only aberration noticeable in the Bitcoin S2F live information chart model. Taking a look at the historic calculations of the value of Bitcoin according to PlanB’s model, there are several lengthened favorable aberrations where BTC has been over-priced as compared to the supply dynamic of the asset. The longest duration for these aberrations lasts from 2013 to 2015.

As the industry and the correlated markets progress at such a rapid pace, it is possible that there could be new quantitative appraisal designs that price Bitcoin in a much more precise style. PlanB himself has actually upgraded the original S2F model with an upgraded version, the BTC Stock to Flow cross-asset (S2FX) model.

What is the Bitcoin Stock-to-Flow cross-asset model?

After the immense appeal of PlanB’s Stock-to-Flow model that ignited the interest of monetary analysts around the world, in April 2020, through another Medium post, PlanB exposed another quantitative assessment model called the Bitcoin Stock-to-Flow cross-asset (S2FX) model.

This new model intends to solidify the basis of the currently used S2F model by getting rid of time as a variable and even adding other similar scarce properties like silver and gold. Basically, it makes it possible for the valuation of BTC, gold and silver utilizing simply one formula. To describe this model, PlanB uses the principle of stage transition to explain how assets behave differently at various stages of its lifecycle.